OUR GUIDING PRINCIPLES & PHILOSOPHY OF EXECUTION

“ex-e-cu-tion”

“Sebvest Group was born out of the philosophy of ex-ecu-tion. It is how we think, how we approach every deal, how we structure relationships. Ex-e-cu-tion is what we have become. We owe our success of our ability to Getting Things Done.”

GEORGE SEBULELA

Group Chairman & President of Sebvest Financial Services Group

12J REGIME

One of the main challenges to the economic growth of small and medium-sized businesses is access to equity finance

To assist government and SARS have implemented a tax incentive for investors in Venture Capital Companies or VCC’s through the “VCC regime”

This has become subject to the provisions of Section 12J of the Income Tax Act

It offers full 100% tax relief / deduction for Investors in exchange for the issue of venture capital shares, including expenditure actually incurred to acquire shares in approved VCCs

STRUCTURED INVESTING

INVESTMENT

Sebvest 12J

INVESTMENT

Sebvest Private Equity

TRANSACTION

Sebvest Fund Managers

TRANSACTION

Sebvest Treasury

SUSTAINABILITY

Sebvest Financial Services

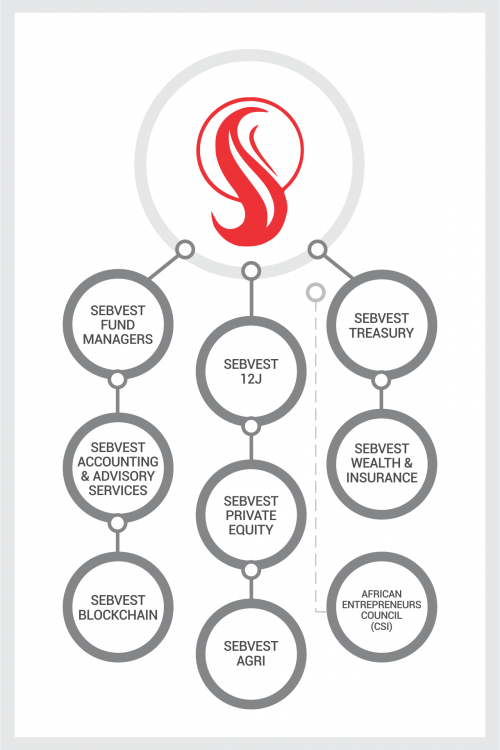

OUR 8 COMPANIES

Our 8 companies represent our core processes of investment, transaction and sustainability as well as embodying the group’s ethos.

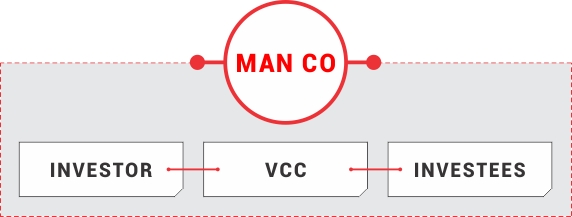

12J SETUP

- Investor invests into a VCC and is issued an investor share certificate by the VCC

- VCC Invests into qualifying Investee businesses and receives share certificate

- Entire workflow is managed by a management company

“If opportunity doesn’t knock, build a door.”

- MILTON BERLE

VCC KEY POINT 1

COMPLIANCE

- Must be registered with the FSB as a Financial Services Provider CAT 1, sub section 7 – Securities & Financial Instruments

- Must be registered for Income Tax, PAYE and VAT with SARS

- Must have a registered Key Individual

- Must have an independent Compliance Officer and Company Secretary

- Must have a minimum of 2 current accounts and 1 call account with a registered banking institution

VCC KEY POINT 2

STATUTORY

- Authorised share capital minimum, 1 million shares at R1000 per share

- Must have a minimum of 2 directors

- Must have a Private Placement Memorandum

- Must have a Memorandum of Incorporation

- Must have an Investment Committee and Audit Committee with a minimum of 2 participants in each

- Must maintain record of all Investors and Investees

VCC KEY POINT 3

INVESTMENT

- Can not own more than 69,9% equity on a company

- An Investee can not have a post funding NAV of more than R50mil

- A VCC can not invest more than 20% of the fund into a single project

- A VCC has 5 years to disburse Funds once they are invested

INVESTOR & INVESTEE KEY POINTS

INVESTOR

- Can be a (Pty) Ltd, Individual or a Trust

- No Investor can own more than 20% of the VCC, the VCC has 3 years to dilute and comply

- An investor has to remain in the VCC for a minimum of 5 years

- Can not participate in the management of the VCC

- CGT applies at the time of disposing of VCC shares

INVESTEE

- The Investee must not be a controlled group company in relation to a group of companies.

- The company’s tax affairs must be in order (a valid tax clearance certificate is a must);

- The company must be an unlisted company (section 41 of the Act)

- VCC Can not own more that 69,9% on the shares

- No related party to any Investors

- The Investee can not be

- An Immovable Property

- A Professional Services Business

- A Sin business such as alcohol or gambling

The Sebvest is a robust and attractive venture capital company producing strong returns in addition to the tax break received using this structure.

12J fund offers innovative share options for all types of clients

Sebvest has a strong value proposition from pre to post-investment and has a strong differentiator to the market with our holistic approach and strong risk management processes.

It is managed excellently, professionally and accurately with strong governance as well as strategy and is assisted by market leading partners.

SEBVEST 12J STANDS HEAD AND SHOULDERS ABOVE OTHER 12J FUNDS DUE TO ITS HOLISTIC APPROACH AS WELL ITS ABILITY TO MANAGE RISK THROUGH TRACK RECORD, A STRONG MANAGEMENT TEAM AND ITS STRICT PRE AND POST INVESTMENT PROCESSES.

A strong team of professionals and a board comprising CA (SA)’s, MBA’s and Doctors with expertise in M&A, Audit, Investment and Risk coupled with strong track records of success means the fund is poised for high returns at well managed risk.

A strong due diligence process with strict hurdles and market lever achievements pre investment

A hands on approach at grass root levels of financial and managerial functions of each business post investment to ensure not only sustainability but also growth

Each investment will receive a Sebvest 12J member on the management board which ensures that the business growth strategy is planned and implemented with accuracy

Businesses can rise and fall on its working capital management and with Sebvest Treasury the investment business is ensured that this function of the company is always looked after, should the need arises

As a Black Owned 12J fund all investments count to BEE points which gives the fund an additional value add proposition not only for the investor but the businesses it invests into.

The Sebvest 12J Fund was initially setup with 5 share classes:

1. Income Share

2. Stable Share

3. Growth Share

4. Structured share

5. Enterprise development share

The proposed Agri Investment will fall under the Income Share Class

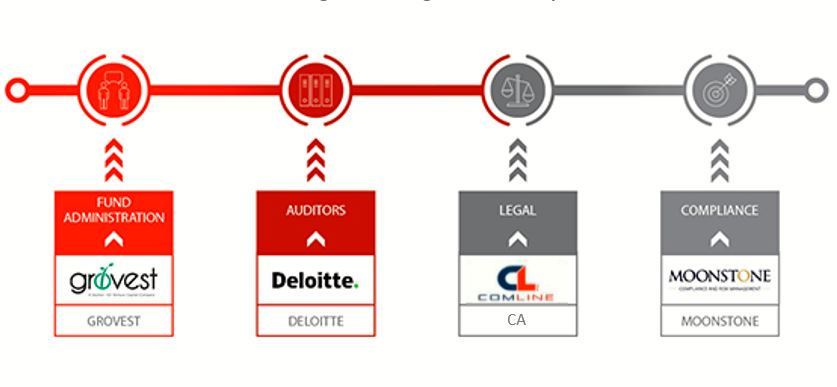

The governance of a fund is crucial to its success. The fund must be managed to a strict ethos of professionalism and integrity to ensure that trust is developed between investors and investees alike. This trust translates into confidence and the ability to grow together.

Sebvest Capital Partners prides itself in the strong management team and board it comprises of. This strength aids in building an ethical and driven culture and ethos in the company.

Sebvest Capital Partners takes accountability very seriously, which is just as important from a statutory and regulatory stand point.

To meet all statutory and regulatory requirements and to hold Sebvest Capital Partners and it’s management team accountable, the following audit, legal and compliance officers have been selected:

Sebvest 12J and Sebvest Capital Partners are proud members of

CONTACT DETAILS

Head Office

Hertford Office Park, 90 Bekker Road

Ground Floor, Building D,

Vorna Valley, Midrand,

Johannesburg, South Africa

– – –

CALL: 011 312 2324

– – –

FAX: 011 312 2325

– – –

MAIL: info@sebvestcapitalpartners.com